How Mortgage Rate Fluctuations Shape Your Buying Power

Buyers Herbert Riggs August 19, 2024

Buyers Herbert Riggs August 19, 2024

For individuals considering the purchase or sale of a home, mortgage rates are likely at the forefront of their minds. This is because the prevailing mortgage rates directly influence the affordability of their monthly mortgage payments, a crucial aspect to consider in their financial planning. Here's a breakdown of what you should be aware of:

Current Trends in Mortgage Rates

In recent times, mortgage rates have been on a downward trajectory. While this bodes well for those looking to buy a home, it's essential to recognize that rates can be unpredictable due to their sensitivity to various factors.

Elements such as the overall state of the economy, the job market, inflation rates, and decisions made by the Federal Reserve all contribute to the fluctuation of mortgage rates. Therefore, despite the downward trend, rates can still experience fluctuations based on new economic data. Odeta Kushi, Deputy Chief Economist at First American, notes: “The ongoing deceleration in inflation, coupled with the Federal Reserve’s recent indication of potential rate cuts [in 2024], suggests an environment supportive of modest declines in mortgage rates. Barring any unforeseen circumstances and resurgence in inflation, lower mortgage rates could be on the horizon, but the journey towards them might be slow and bumpy.”

Implications for You

Changes in mortgage rates directly impact the amount you pay each month towards your home loan. Even a slight adjustment in rates can significantly alter your monthly financial obligations.

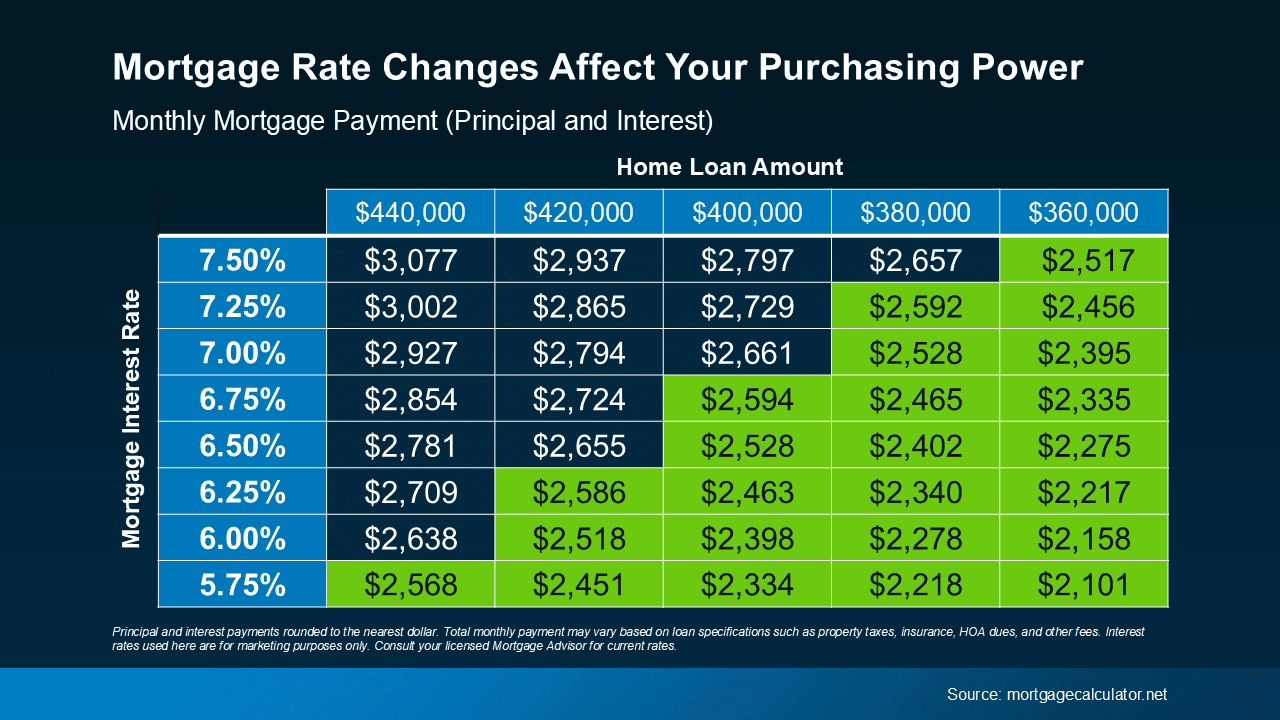

Consider the chart below to visualize how varying mortgage rates influence your monthly house payment across different loan amounts. For instance, if you can comfortably manage a monthly payment of $2,600 for your home loan, the chart illustrates payments within that range or lower based on different mortgage rates (see chart below):

Enhancing Your Decision-Making through Mortgage Rate Awareness

Staying informed about how mortgage rates influence your monthly payments is key to making informed choices.

How to Stay Informed about Mortgage Rates

Real estate agents possess the knowledge to explain the current landscape and its implications for you. They can offer resources like the aforementioned chart to illustrate how rate fluctuations impact your purchasing capacity.

You don't have to be a mortgage expert; all you need is a professional partner by your side. Someone who can decode market trends and support you throughout your buying or selling process.

In Conclusion If you have inquiries regarding the real estate market, let's connect. This way, you can gain insights into the market dynamics and receive guidance on how to navigate them effectively.

Stay up to date on the latest real estate trends.

Riggs & Co. has established an award-winning real estate practice with a vision that pays attention to detail and provides extraordinarily intelligent advice.